Often hailed as the "eighth wonder of the world" by financial luminaries, compound interest is more than just a financial term; it's a powerful engine for wealth creation and financial freedom. But what exactly is this phenomenon, and why does it hold such immense power in the world of investing? More importantly, how can you harness its potential to significantly grow your wealth over time and achieve your financial goals?

This comprehensive guide will demystify the magic of compound interest, provide clear examples of its powerful effect, highlight essential tools to calculate your potential returns, and unequivocally explain why starting your investment journey early can make all the difference. By the end, you'll understand why embracing compound interest is not just a strategy but the fundamental cornerstone for building a successful and secure financial future.

What is compound interest? The Snowball Effect of Wealth

At its core, compound interest is the process of earning interest not only on your initial investment (the principal amount) but also on the accumulated interest from previous periods. Unlike simple interest, which is calculated solely on the original principal, compound interest creates a self-reinforcing cycle of growth. The interest you earn gets added back to your principal, and then that larger sum earns even more interest. This is often referred to as the "snowball effect" because your money grows exponentially, much like a snowball rolling downhill and gathering more snow as it goes.

Think of it this way:

Simple Interest: You earn interest on the original amount you put in. Like putting money in a jar and adding a fixed amount of interest each year.

Compound Interest: You earn interest on your original amount plus any interest that has already been added to that amount. It's like putting money in a magical jar where the interest itself starts earning interest, accelerating your wealth accumulation.

The Formula Behind Compound Interest: Understanding the Mechanics

While the concept is straightforward, understanding the compound interest formula can provide a deeper appreciation for its mechanics. Don't worry—we’ll quickly introduce user-friendly tools below that do the heavy lifting for you!

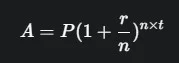

The standard compound interest formula is

Let's break down what each variable represents:

A: The future value of your investment is the total amount you will have after interest has compounded. This is your ultimate wealth accumulation.

P: The principal amount; your initial investment or starting amount of money.

r: The annual interest rate is the stated interest rate for the year, expressed as a decimal (e.g., 8% is 0.08). This is your return on investment (ROI).

n: The Number of Times Interest is Compounded Per Year; this indicates how frequently your interest is calculated and added to your principal (e.g., annually n=1, semi-annually n=2, quarterly n=4, monthly n=12, daily n=365). The more frequent the compounding, the faster the growth.

t: The Number of Years the Money is Invested; the duration over which your money will grow. This highlights the crucial role of time in the market.

While the formula might look complex, its purpose is to mathematically illustrate the exponential growth that happens when your interest itself begins to earn interest.

Why Compound Interest Works Like Magic: The Power of Time in the Market

The true magic of compound interest lies in its relentless ability to build momentum over extended periods. The longer you leave your money invested, untouched, and allowed to compound, the more dramatic and pronounced this exponential effect becomes. This is the essence of long-term investing.

Consider this progressive growth cycle:

After 1 year, interest is earned on your initial deposit (principal).

By Year 2: Interest is earned on both the initial principal and the interest accumulated from year 1. Your base for earning interest has grown.

By Year 5: The accumulated interest starts to become a significant portion of your overall investment, earning its own interest.

By Year 10 or 20 (The Sweet Spot): This is where the snowball effect truly kicks in. The accumulated interest becomes so substantial that it earns a considerable amount of new interest, significantly accelerating your wealth accumulation.

This relentless, accelerating growth is precisely what makes long-term investing so incredibly powerful and is why successful financial planning always emphasizes starting early. It's not about timing the market but about time in the market.

Examples of How Compound Interest Works Over Time: Numbers Speak Loudest

Let's look at some tangible examples to truly illustrate the incredible power of compound interest:

Example 1: $10,000 Invested at 8% Annual Return

Imagine you make a one-time investment of $10,000 into a diversified stock market fund, historically achieving an average annual return of 8% (a common historical average for broad market indices).

After 1 year, your investment grows to $10,800 ($10,000 principal + $800 interest).

By year 5, your money has reached $14,693.

By year 10, your initial investment has more than doubled to $21,589. The interest earned in year 10 alone is over $1,500.

By year 20, you're looking at a substantial $46,610. Your money has quadrupled!

Fast-forward to Year 30: Your original $10,000 has ballooned to an astonishing $100,626.

The Staggering Difference: If this were simple interest, you would only make 8% of $10,000, or $800 per year. Over 30 years, that would be $24,000 in interest, bringing your total to just $34,000. Thanks to compound interest, your initial investment more than doubles (from $34,000 with simple interest to $100,626), with almost $90,000 of your total as pure interest earnings! This clearly demonstrates the immense benefit of letting interest earn interest.

Example 2: Starting Early vs. Starting Late—The Cost of Waiting

Now, let's consider a powerful scenario with two hypothetical investors, Ashley and Ben, both aiming for financial freedom by age 65, with an average 8% annual return:

Ashley (The Early Bird): Starts investing $3,000 annually at age 25. She consistently invests for only 10 years and then stops (investing a total of $30,000).

Ben (The Late Bloomer): Waits until age 35 to start investing $3,000 annually. He invests consistently for 30 years (investing a total of $90,000).

By age 65, whose investment holds more value? Surprisingly, Ashley's investment grows to approximately $440,000, despite only investing $30,000! Ben's investment only reaches around $360,000, even though he invested three times as much money (a total of $90,000) and continued investing for a longer period of his active life.

This stark contrast dramatically highlights the unparalleled importance of starting early. Compound interest gives Ashley's money decades of uninterrupted time to grow and snowball, while Ben is playing catch-up, illustrating the significant opportunity cost of delaying your investment journey.

Tools to Calculate Compound Interest Returns: Simplify Your Financial Planning

If the compound interest formula feels overwhelming, don't worry. You don't need to be a math expert to harness its power. Several easy-to-use tools and calculators can help you effortlessly forecast returns and plan your investments with confidence.

Online Compound Interest Calculators:

These are the easiest ways to visualize your potential growth.

How to Use: Simply input your initial investment, additional contributions (if any), estimated annual interest rate, the number of years you plan to invest, and the compounding frequency (daily, monthly, quarterly, or annually).

Recommended Sites:

Investor.gov's Compound Interest Calculator (U.S. SEC's official site, very reliable).

Bankrate's Compound Interest Calculator offers various scenarios, including additional contributions.

NerdWallet's Compound Interest Calculator (clear interface with helpful explanations).

Tip: Experiment with different scenarios (e.g., what if I add $50 more per month? What if I get a 1% higher return? to see the impact.

Excel or Google Sheets:

These powerful spreadsheet tools have built-in functions for complex financial planning.

How to Use: The

FV(Future Value) function is your best friend.=FV(rate, nper, pmt, [pv], [type])rate: The interest rate per period (e.g.,8%/12for 8% annual compounded monthly).nper: Total number of payment periods (e.g.,years * 12for monthly compounding).pmt: The payment made each period (your additional contributions).pv(optional): The present value or initial investment (as a negative number).type(optional): When payments are made (0 for end of period, 1 for beginning).

Tip: You can create custom tables to track your progress and run more detailed what-if analyses.

Investment Apps & Brokerage Platforms:

Many popular investment apps and brokerage platforms offer integrated tools to estimate returns and visualize growth within your actual portfolio.

Examples: Apps like Fidelity, Vanguard, Charles Schwab, Betterment, Wealthfront, and others provide intuitive interfaces that show how your money could grow when contributions and dividends are reinvested over time.

Tip: These tools often allow you to factor in your specific contribution schedule and even project how different portfolio allocations might affect your wealth accumulation.

Having easy access to these tools allows you to explore various investment scenarios, understand the nuances of compound interest frequency, and make data-driven decisions to maximize your returns and accelerate your journey towards financial freedom.

Reinvesting Dividends to Supercharge Growth: An Investor's Secret Weapon

One of the most effective, yet often overlooked, ways to significantly amplify the power of compound interest is through reinvesting dividends. When you invest in assets like stocks, mutual funds, or Exchange-Traded Funds (ETFs), many of them pay out regular dividends – a portion of the company's or fund's earnings distributed to shareholders in the form of cash.

Why Reinvesting Dividends Works Like Magic:

Instead of pocketing this cash payout, many savvy investors choose to reinvest those dividends directly back into their portfolio. This means using the dividend income to buy more shares of the same stock or fund. Over time, this creates a powerful feedback loop:

Increased Share Count: Each reinvested dividend buys you more shares of the investment.

More Dividends: Those newly acquired shares then begin to generate their own dividends, adding to the next payout.

Accelerated Compounding: This continuous cycle of more shares generating more dividends that buy even more shares significantly accelerates the overall compounding effect on your total investment value. Your investment grows faster than if you just kept the cash.

Automated Dividend Reinvestment Programs (DRIPs):

Many investment platforms and brokerages offer a convenient feature called a Dividend Reinvestment Program (DRIP). This program automatically takes any dividends you receive and uses them to purchase additional shares (or fractional shares) of the same investment. DRIPs allow investors to supercharge their compound interest growth without any extra manual effort or transaction fees.

For example, if you own a dividend stock with a 4% annual yield, and you enable DRIPs, that extra 4% income compounds on itself year after year, driving your wealth accumulation even higher. This strategy aligns perfectly with the principle of dollar-cost averaging, as you are consistently buying more shares over time, regardless of market fluctuations.

Why Starting Early Pays Off: Time is Your Ultimate Investment Ally

When it comes to harnessing compound interest, time is not just a factor; it is your greatest and most irreplaceable asset. The earlier you begin your investment journey, the more profound and transformative the power of compound interest becomes. This is because the compounding effect works its most impressive magic over long periods, giving your investment the crucial runway it needs to grow exponentially.

The Irrefutable Case for Early Action and Consistent Investing:

More Time to Grow & Compound: Even small contributions made early in life (e.g., in your 20s or 30s) can snowball into significantly larger sums by retirement age, far outweighing larger contributions made later. This is the opportunity cost of waiting – every year you delay is a year of lost compounding.

Flexibility in Contributions: Starting early allows you to invest smaller, more manageable amounts gradually. This fosters sustainable financial discipline and prevents the stress of trying to save massive sums in a shorter timeframe later in life.

Mitigating Market Risks: Longer investment horizons help smooth out the inevitable ups and downs of market volatility. Short-term fluctuations become less impactful over decades, allowing your investments to ride out dips and benefit from long-term trends.

Reduced Stress: Knowing your money is working hard for you through compound interest provides immense peace of mind and reduces financial anxiety as you approach your financial goals.

A Simple Takeaway for Young & New Investors: If you're young and new to the world of investing, here’s the most crucial advice: starting small is infinitely better than waiting for the "perfect" time or a large sum. Even a modest monthly investment of $50 or $100 into a low-cost index fund or ETF can, with the help of compound interest, snowball into substantial gains, building a foundation for financial freedom that you will deeply appreciate down the road.

Make Compound Interest Work for You: Your Path to Financial Success

Compound interest is truly a game-changer in the investing world, offering a profound reward for patience, consistency, and a disciplined approach to your finances. By taking the time to understand how it works, utilizing readily available tools to forecast your potential returns, and intelligently reinvesting dividends, you can unlock the immense potential of this powerful wealth creation tool.

Remember, when it comes to compounding, starting early is everything. Whether you’re just setting aside a little money each month or making more significant contributions to your investment portfolio, the key is to begin as soon as possible. The earlier your money starts working for you, the more substantial your wealth accumulation will be.

Ready to take control of your financial future and start growing your wealth strategically?

Use one of the free compound interest calculators linked above to visualize your potential gains and set realistic financial goals.

Consider opening a low-cost investment account (e.g., a brokerage account, Roth IRA, or 401(k) if available) and automating small, regular contributions.

For personalized financial planning and tailored investment strategies, consult with a qualified financial expert. They can help you chart the most effective path forward for your unique circumstances.

The sooner you start harnessing the power of compound interest, the more you’ll thank yourself down the road on your journey to financial freedom.